Fraude Zelle: La presión para mejorar la protección del consumidor

Zelle ha redefinido la forma en que las personas transfieren dinero, ofreciendo el tipo de velocidad y comodidad que rara vez se asocia con las transacciones financieras. No es de extrañar que, con más de 120 millones de usuarios y la asombrosa cifra de 806.000 millones de dólares transferidos en 2023, Zelle siga siendo una de las plataformas de pago entre particulares más populares. Pero lo que hace que Zelle sea atractivo para los consumidores también atrae a los estafadores. Un creciente número de incidentes de fraude relacionados con la aplicación Zelle ha llevado a las autoridades federales a examinar más de cerca la forma en que los bancos protegen a sus clientes.

Por qué los estafadores se fijan en Zelle

El sistema de pago irreversible y en tiempo real de Zelle es uno de sus mayores puntos fuertes y su mayor vulnerabilidad. A diferencia de las tarjetas de crédito o los cheques, los pagos realizados a través de Zelle no pueden detenerse ni impugnarse una vez enviados. Si un estafador consigue que un usuario realice un pago, recuperar esos fondos es prácticamente imposible.

Estadísticamente, el fraude representa un pequeño porcentaje de las transacciones de Zelle -apenas el 0,1% en 2023-, pero esa cifra sigue traduciéndose en pérdidas significativas debido a la enorme escala de Zelle. Por ejemplo, 403 millones de dólares de los 806.000 millones transferidos ese año estaban potencialmente relacionados con estafas o fraudes en los pagos.

La cosa no se detiene ahí. Los informes muestran que las estafas vinculadas a apps de pago se están acelerando. Solo en el primer semestre de 2024 se notificaron a la Comisión Federal de Comercio más de 41.000 casos que supusieron pérdidas por valor de 171 millones de dólares.

La investigación federal sobre el fraude de Zelle

Wells Fargo revela que las autoridades estadounidenses están investigando las quejas sobre Zelle. La Oficina de Protección Financiera del Consumidor (CFPB) ha puesto en marcha una investigación sobre si los bancos están haciendo lo suficiente para hacer frente al fraude de Zelle. Su atención se centra en si los bancos actúan con suficiente rapidez para cerrar las cuentas relacionadas con estafas y si disponen de medidas suficientes para evitar que los estafadores se registren en primer lugar.

Aunque los bancos reembolsan a los clientes las transacciones no autorizadas, la mayoría considera que las estafas -transacciones técnicamente autorizadas por un usuario bajo coacción o engaño- quedan fuera de su obligación. La empresa matriz de Zelle, Early Warning Services, ha introducido políticas que obligan a los bancos a reembolsar a los usuarios estafados por suplantadores de ciertas organizaciones de confianza, perolos informes indican que entre el 80 % y el 85 % de las víctimas de estafas seguían sin recibir ningún reembolso en 2024.

Mientras tanto, grandes bancos como JPMorgan Chase insisten en que ya ofrecen importantes protecciones y sostienen que no deberían estar sujetos a una normativa más estricta. El banco ha destacado el sólido historial de seguridad de Zelle cuando se utiliza de forma responsable.

Cómo Zelle y los bancos abordan el fraude

Zelle y los bancos participantes han adoptado medidas para reducir el fraude en los pagos digitales. Entre ellas, alertar a los usuarios para que solo envíen dinero a personas de confianza, vigilar las actividades sospechosas y utilizar herramientas de evaluación de riesgos para señalar las transacciones arriesgadas.

Sin embargo, sigue habiendo problemas. Las denuncias de estafas requieren medidas rápidas, como la congelación de las cuentas sospechosas, para impedir que los malhechores retiren inmediatamente los fondos robados. También se necesitan métodos más proactivos, como seleccionar a los destinatarios y proporcionar advertencias detalladas sobre posibles estafas.

Presentamos una solución fiable a las estafas digitales

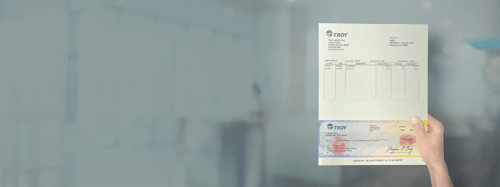

Aunque abordar el fraude de Zelle es fundamental, la conversación más amplia en torno a la seguridad de los pagos pone de relieve el valor de alternativas como los cheques para determinados tipos de transacciones. A diferencia de muchos métodos de pago digitales, los cheques ofrecen una forma de pago rastreable y segura, especialmente cuando se imprimen con tecnologías avanzadas de prevención del fraude en pagos digitales como TROY MICR Toner Secure.

Por qué los cheques siguen siendo una opción segura

Los cheques siguen siendo una opción de pago fiable debido a sus características de seguridad y trazabilidad, especialmente cuando se integran con medidas de protección mejoradas. Con un 80% de empresas que utilizan cheques para realizar transacciones B2B, y un 42% de millennials que todavía escriben cheques regularmente, Sin embargo, el fraude con cheques está en aumento, con estafadores que lavan cheques y los depositan para su propio beneficio. Sin embargo, cuando se imprimen con TROY MICR Toner Secure, los cheques ofrecen una sólida capa de protección contra el fraude de cheques a través de las siguientes características:

- Resistencia al fraude: TROY MICR Toner Secure incluye un tóner único y patentado que protege los cheques del lavado por sangrado. Esta ingeniosa tecnología ha ayudado a bancos y empresas a combatir el fraude y recuperar cientos de miles de dólares.

- Trazabilidad: Cada cheque sirve como registro físico de la transacción, dejando un rastro claro de la misma. Esa transparencia hace que las actividades fraudulentas no sólo sean difíciles de ejecutar, sino también más fáciles de rastrear y perseguir.

- Adaptables a las necesidades: Desde desembolsos de nóminas hasta grandes transacciones, los cheques impresos con tecnología MICR segura se adaptan a una amplia gama de necesidades empresariales y personales, devolviendo el control a sus manos.

Razones para utilizar cheques seguros

Dada la naturaleza irreversible de las plataformas de pago digitales como Zelle, los cheques producidos con tecnología antifraude líder del sector proporcionan tranquilidad a los consumidores. Tanto si se trata de pagos de gran valor como de interacciones con destinatarios menos conocidos, los cheques ofrecen una opción segura que combina eficiencia y responsabilidad.

El futuro de la seguridad en los pagos

Las plataformas digitales como Zelle han revolucionado sin duda los pagos, pero el aumento de las estafas demuestra que incluso los sistemas más modernos requieren mejoras constantes. Los bancos, los reguladores y los consumidores tienen un papel que desempeñar para que las plataformas sean más seguras. Los cheques seguros, especialmente los impresos con TROY MICR Toner Secure, siguen siendo una forma fiable de combatir el fraude. Al equilibrar la comodidad de los pagos digitales con la integridad de los métodos tradicionales, podemos forjar un camino más seguro para las transacciones financieras en el futuro.

Tanto si confía en la tecnología más avanzada como en soluciones tangibles y fiables, mantenerse informado es clave para estar protegido.

Más información sobre MICR Toner Secure en nuestro sitio web.

Entradas relacionadas

Guía para elegir el mejor software de impresión de cheques

En el vertiginoso mundo de los negocios, la eficiencia es clave. Un ámbito en el que la eficiencia puede tener un impacto significativo es el de la impresión de cheques y el software de impresión de cheques. As..

5 ventajas de imprimir con tintas curables UV

Cuando se trata de la industria de la impresión, la velocidad y la fiabilidad adquieren una importancia increíble. Los clientes quieren imprimir rápido y sin riesgo de daños o manchas. Negocio..

5 Ventajas de una máquina insertadora de carpetas

Empecemos este blog con una sencilla historia sobre Mark, un director del departamento de cuentas por pagar encargado de las responsabilidades financieras de una empresa en crecimiento. A medida que la empresa se expande, so..

Dejar una respuesta